tax avoidance vs tax evasion uk

This is much easier to define as to have. The tax evasion vs tax avoidance debate is a long-standing one.

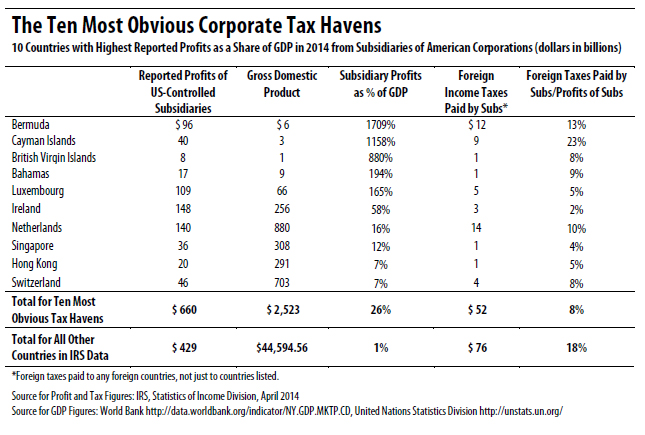

New Uk Law May Shut Down The Biggest Tax Havens Aside From The U S Itep

On 16 Feb 2022.

. In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine. Tax evasion on the other hand is using illegal means to avoid paying taxes. It always creates a lot of anger and questions about how to get away with.

Tax planning either reduces it or does not increase your tax risk. HMRCs work on the tax gap. Usually tax evasion involves hiding or misrepresenting income.

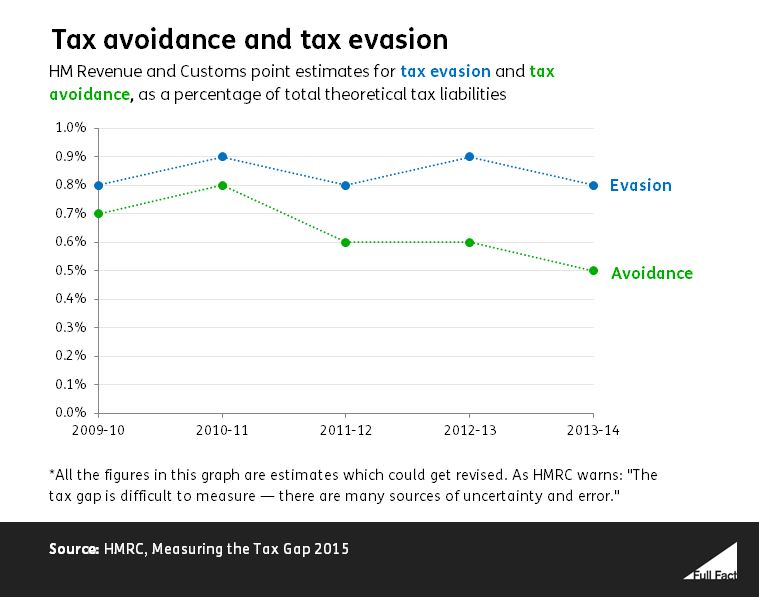

In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the two.

Tax avoidance is structuring your affairs so that you pay the least amount of tax. Fraudsters who carried out a 100 million tax avoidance fraud have been sentenced to 27 years in prison. Tax avoidance has always created interesting news.

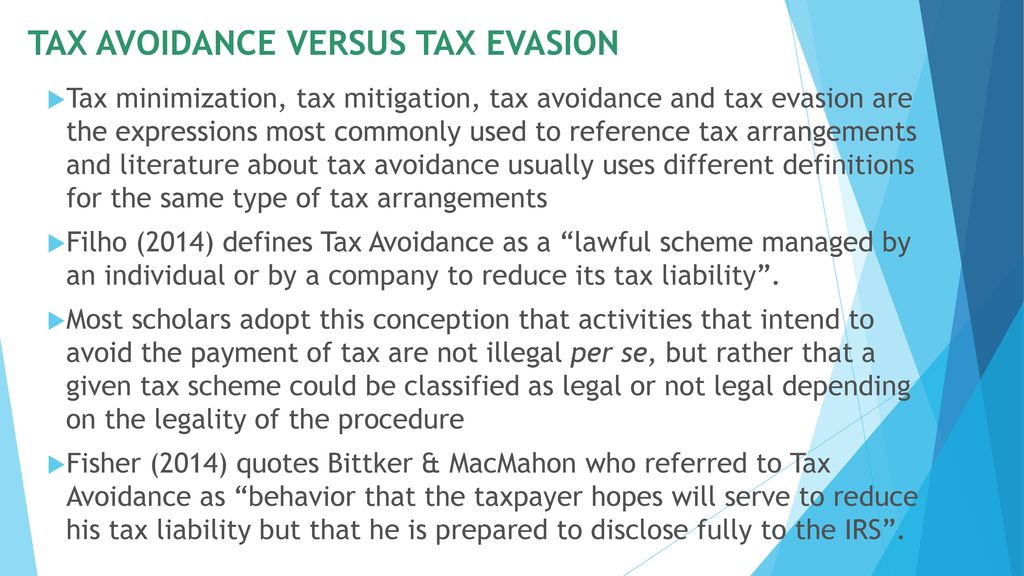

Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax. Tax evasion is a felony. The difference between tax evasion and tax avoidance largely boils down to two elements.

In its most simplistic form there are plenty of people whose financial. What is tax avoidance and what is tax evasion. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law.

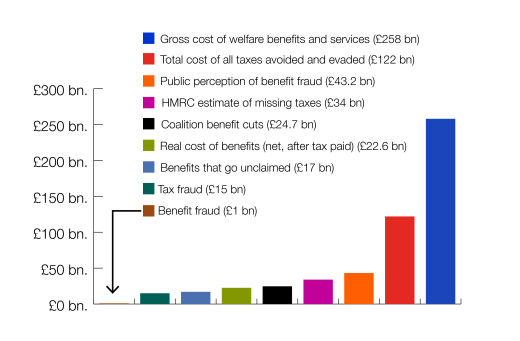

Avoiding tax is legal but it is easy for the former to become the latter. 2 The tax gap 3 The Coalition Governments approach. Tax avoidance and tax evasion Summary 1 Introduction.

Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. It is estimated that in 201920 the. In the UK income tax evasion may result in a maximum penalty of seven years in jail.

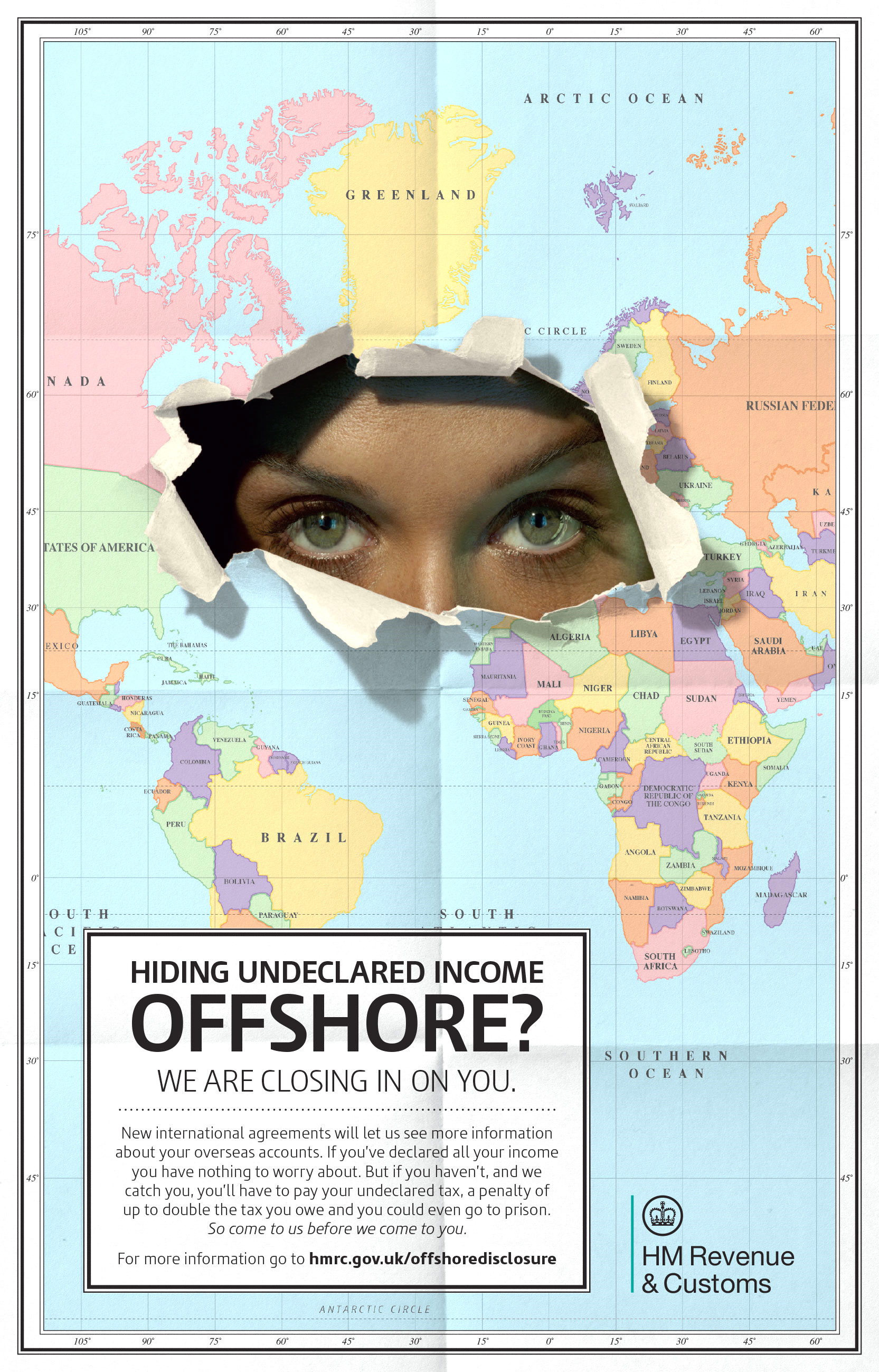

Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down. In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine. The difference between tax avoidance and tax evasion essentially comes down to legality.

It even makes big news for celebrities and large multinationals.

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

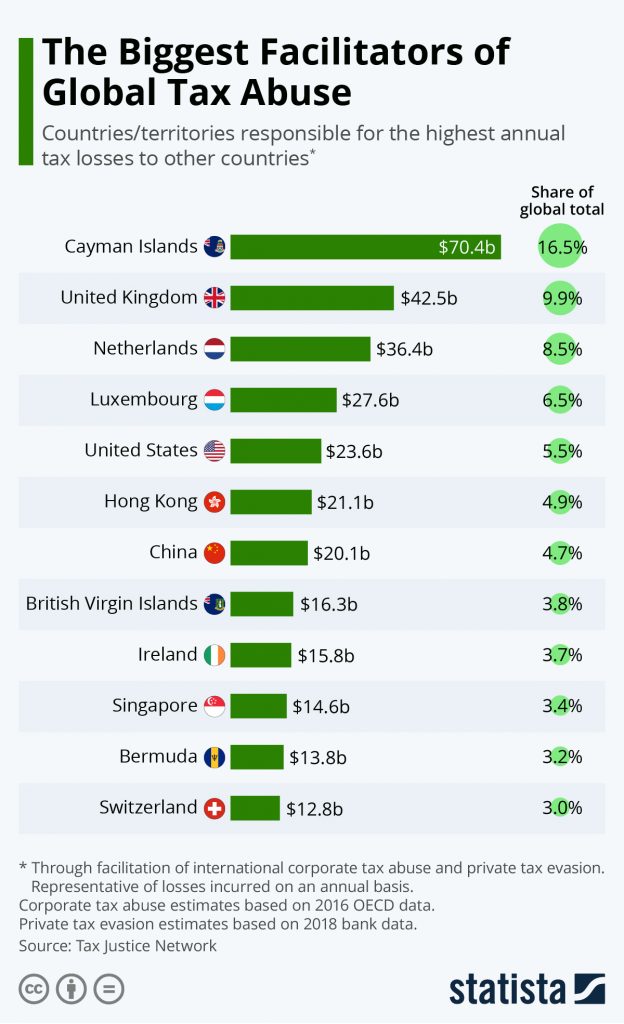

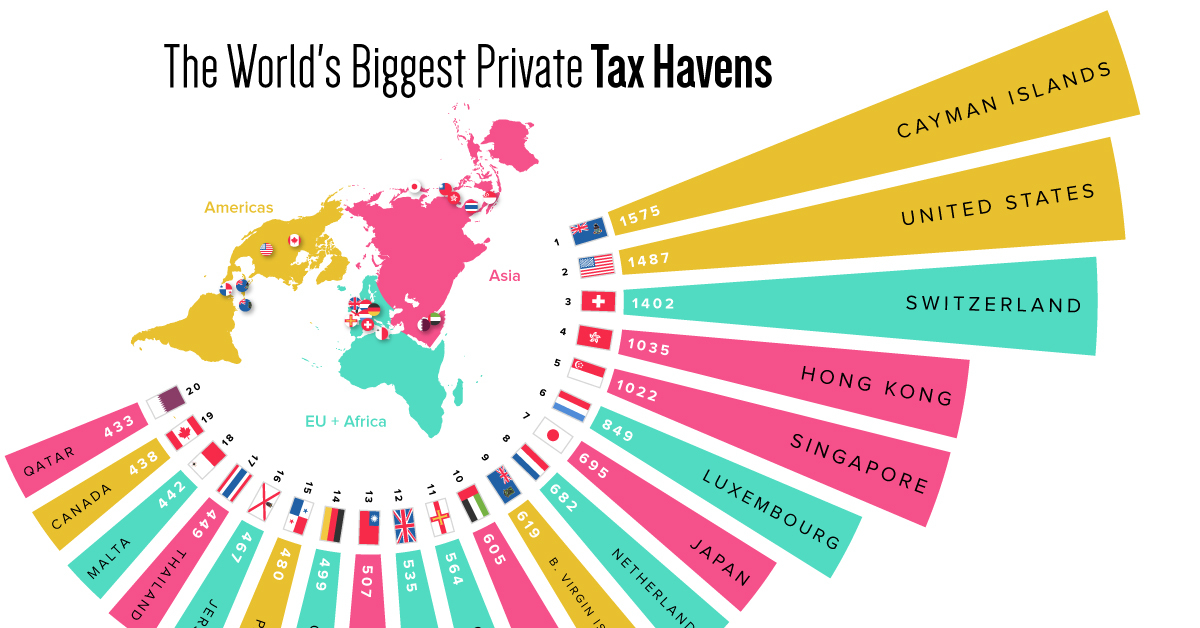

Mapped The World S Biggest Private Tax Havens In 2021

Tax Evasion Vs Benefit Fraud R Ukpolitics

Hugh Grant On Twitter Some Have Pointed Out That I Should Have Said Dwarfed By Tax Evasion And Avoidance They Re Right Hadn T Spotted That Would Love To Know The Separate Figures For

What S The Difference Between Tax Avoidance And Tax Evasion Schemes

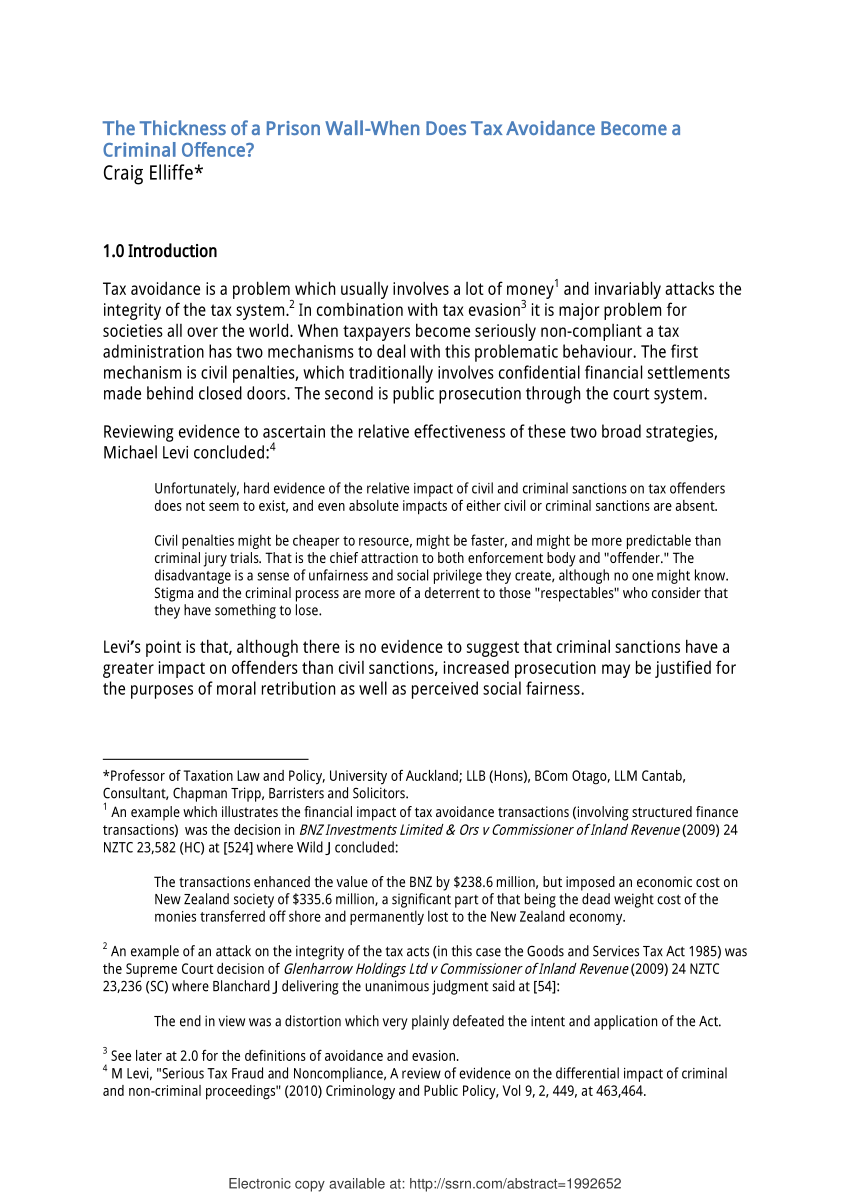

Pdf The Thickness Of A Prison Wall When Does Tax Avoidance Become A Criminal Offence

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet

Celebrity Investors Named In 1 2bn Tax Avoidance Scheme Channel 4 News

Tax Evasion And Avoidance In The Uk Full Fact

The Role Of Parliament In Reducing Tax Evasion And Avoidance Ppt Download

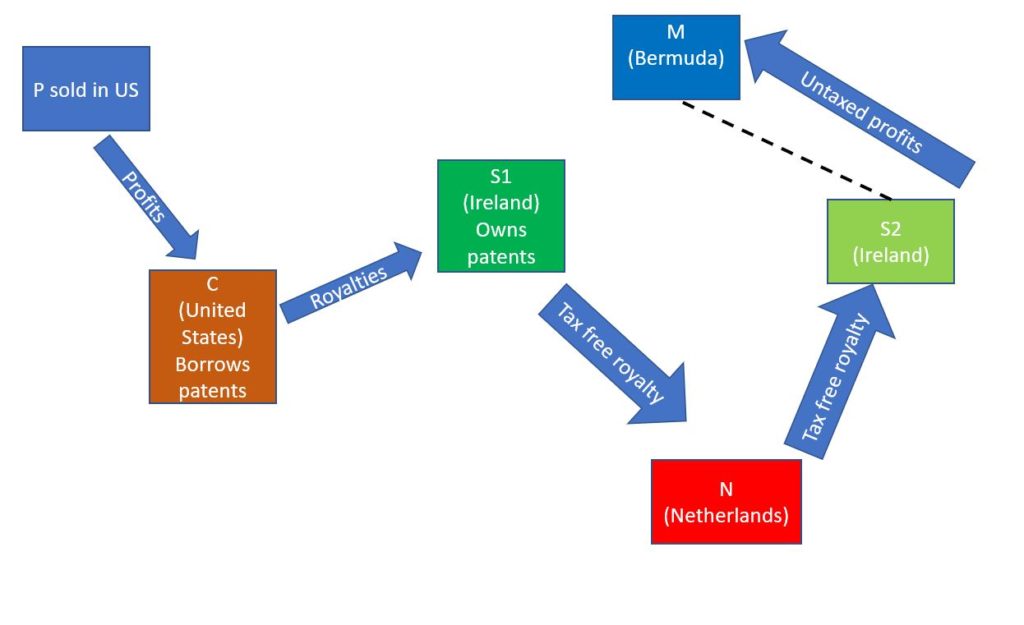

Tax Avoidance Its Effects And Dutch Facilitation Seven Pillars Institute

What Is The Difference Between Tax Avoidance And Tax Evasion

7 Corporate Giants Accused Of Evading Billions In Taxes Fortune