glenwood springs colorado sales tax rate

Name Garfield County Treasurers Office Address 109 8th Street Glenwood Springs Colorado. Gold Hill CO Sales Tax Rate.

Real property tax on median home.

. To begin please register or login below. Sales tax rate in Glenwood Springs Colorado is 8600. You can find more tax rates and allowances for Glenwood Springs and Colorado in.

13 rows Sales Tax Rates in the City of Glenwood Springs. Goldfield CO Sales Tax Rate. 307 City of Colorado Springs self-collected 200 General Fund.

Net taxable sales greater than 100000000 Service Fee reduced to zero. Access the MUNIRevs System. Every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 1 the colorado cities rate 37 and in some case special rate 1.

Gleneagle CO Sales Tax Rate. Sales Tax and Use Tax Rate of Zip Code 81602 is located in Glenwood springs City Garfield County Colorado State. Grand County CO Sales Tax Rate.

It also contains contact information for all self-collected jurisdictions. Did South Dakota v. The glenwood springs colorado sales tax is 290 the same as the colorado state sales tax.

Effective with January 2014 sales tax return the penalty interest rate has changed to 05. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57. MUNIRevs allows you to manage your municipal taxes licensing 24x7.

The sales tax is remitted on the DR 0100 Retail Sales Tax Return. Estimated Combined Tax Rate 860 Estimated County Tax Rate 100 Estimated City Tax Rate 370 Estimated Special Tax Rate 100 and Vendor Discount 40 N. Sales Tax and Use Tax Rate of Zip Code 81601 is located in Glenwood springs City Garfield County Colorado State.

The Glenwood Springs sales tax rate is. Sales Tax State Local Sales Tax on Food. Sales Tax Online Services.

One of a suite of free online calculators provided by the team at iCalculator. 250 total tax rate with accommodation tax. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

The Colorado sales tax rate is currently. 2 State Sales tax is 290. 4 State Sales tax is 290.

5 rows The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales. Grand Junction CO Sales Tax Rate. Estimated Combined Tax Rate 860 Estimated County Tax Rate 100 Estimated City Tax Rate 370 Estimated Special Tax Rate 100 and Vendor Discount 40 N.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. 4 rows Glenwood Springs CO Sales Tax Rate The current total local sales tax rate in Glenwood. Granby CO Sales Tax Rate.

The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state sales tax and 570 Glenwood Springs local sales taxesThe local sales tax consists of a 100 county sales tax a 370 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. The combined amount is 820 broken out as follows. This is the total of state county and city sales tax rates.

If you need assistance see the FAQ. Granada CO Sales Tax Rate. The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a Cap of 100000.

Glenwood Springs CO Sales Tax Rate. The County sales tax rate is. Learn about sales tax rates sales tax returns and more.

What is the sales tax rate in Glenwood Springs Colorado. The City of Glenwood Springs has partnered with MUNIRevs to provide an online business licensing and tax collection system. Golden CO Sales Tax Rate.

Current City Sales Use Tax Rate. Address Phone Number and Fax Number for Garfield County Treasurers Office a Treasurer Tax Collector Office at 8th Street Glenwood Springs CO. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is.

Future job growth over the next ten years is predicted to be 405 which is higher than the US. This system allows businesses to access their accounts and submit tax returns and payments online. The Glenwood Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Glenwood Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Glenwood Springs Colorado.

This document lists the sales and use tax rates for all Colorado cities counties and special districts. Glenwood Springs limits 001 000 RTA Regional Transportation Authority Roaring Fork Aspen and Snowmass Village city limits unincorporated Pitkin County 000 000 RTA Regional Transportation Roaring Fork Areas of unincorporated 001 000 Page 11 of 22 03282022 Use Tax Rates for Districts in Colorado. If your business is located in a self-collected jurisdiction you must apply for a.

Georgia Sales Tax Rates By City County 2022

Arkansas Sales Tax Calculator Reverse Sales Dremployee

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Glenwood Springs Economy Is Strong As City Reports Sales Tax Collection Exceeded 2021 Forecast Aspentimes Com

Florida Sales Tax Rates By City County 2022

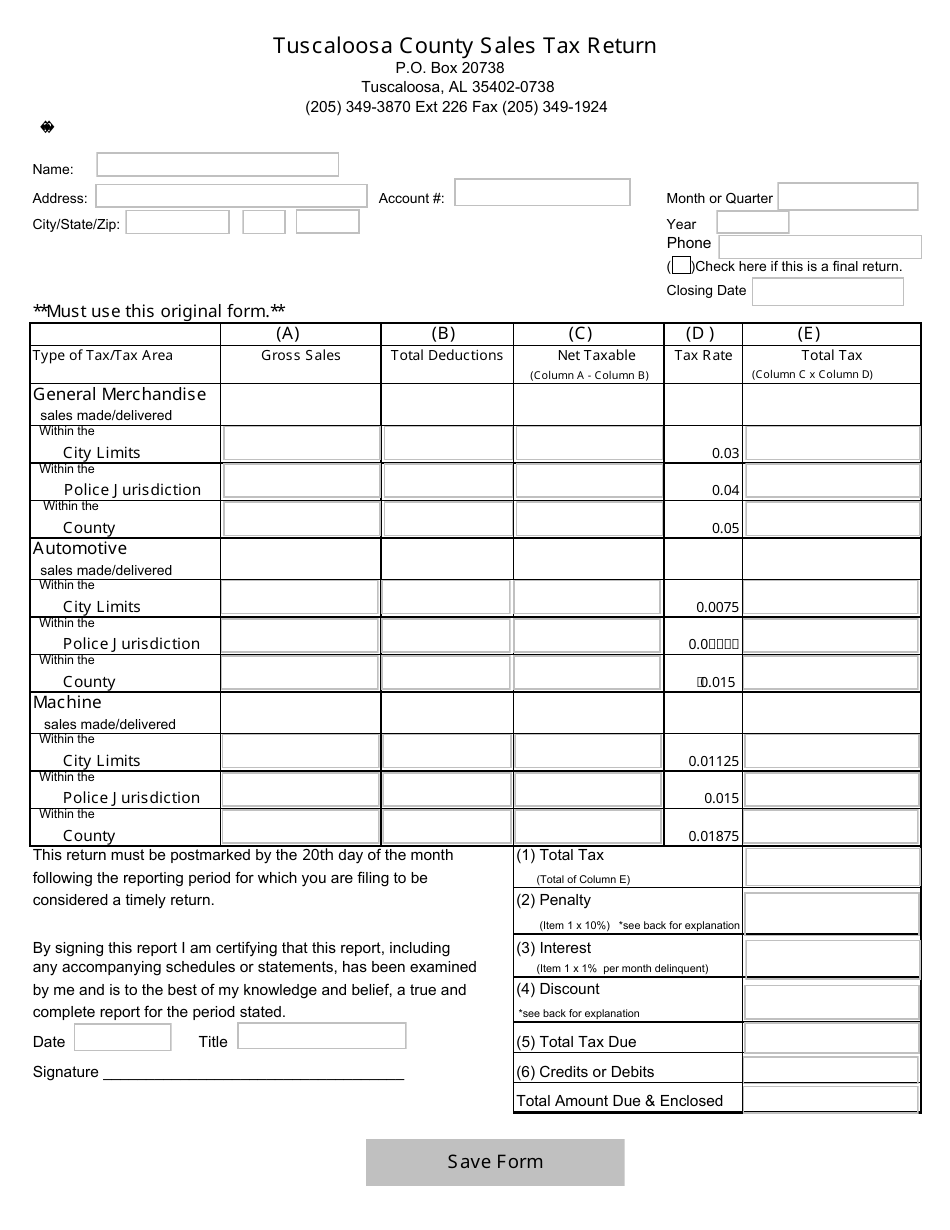

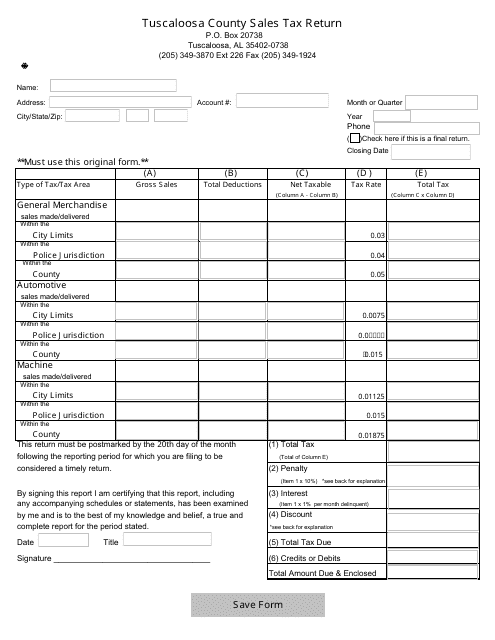

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Florida Sales Tax Rates By City

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Alabama Sales Tax Rates By City County 2022

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Washington Sales Tax Rates By City County 2022

New Mexico Sales Tax Rate Changes In April 2022

Colorado Sales Tax Rates By City County 2022

Marijuana Sales Tax Department Of Revenue Taxation