how to pay late excise tax online

Get your bill in the mail before submitting online. Publication 1854 How to Prepare a Collection Information Statement Form 433-A PDF.

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant

Form 433-B Collection Information Statement for Businesses PDF.

. This is in addition to the 5 percent failure-to-pay penalty. You must file an excise tax return for every excise tax period even if your tax liability is 000 unless you are a qualifying winery. Filing frequencies due dates.

This penalty is in addition to all other penalties. Select the TTB form you want to file. No user fee will be charged.

File or amend my return. Use tax unlike sales tax is due at the rate where you first use the article not where. The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality.

The request must be made before the due date. The excise is based on information furnished on the application for registration of the. Filing for the extension wipes out the penalty.

Contact Us Your one-stop connection to DOR. Notice 2021-66 provides an initial list of taxable chemical substances and guidance for registration with the Form 637 Application for Registration For Certain Excise Tax Activities. Once completed click the NEXT button within the option you choose.

Get excise tax rates. 20 percent substantial understatement of net tax penalty. Dry-cleaning Solvent Tax and License Fees.

Form 433-F Collection Information Statement PDF. Quarterly Excise Tax Payment Procedures. File by mail if you have a waiver.

Item 2 - Form of Payment. If you cannot pay what you owe you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling 800-829-1040. If you are not sure which form you need please visit Business Central to check your filing responsibilities.

Get tax due dates. Excise tax return extensions. The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes.

View or Pay Tax bills Excise Tax Water Sewer Bills. If you have to pay excise duty but dont have an excise licence PSP or movement permission youll need. Be sure to submit your filings and payments on time.

Tax Department Call DOR Contact Tax Department at 617 887-6367. Petroleum-based - 200. Hawaii General Excise Tax Form G-45 is the periodic form that must be filed at intervals throughout the year.

Once you enter your NAME please CLICK one of the options below to continue entering specific information. Depending on the circumstances the Department may grant extensions for filing an excise tax return. 9 am4 pm Monday through Friday.

You must select the Form of Payment. The use tax rate is the same as your sales tax rate. File a permit application to receive approval to operate a TTB-regulated business.

You are personally liable for the excise until the it is paid off. If your vehicle isnt registered youll have to pay personal property taxes on it. Schedule for semi-monthly quarterly and FAET filers.

Section 70 1 late fee for. Internal Revenue Code 4121. Per gallon of solvent purchased chlorine-based - 1000.

100 percent late payment and late filing penalty if you dont file returns for three consecutive years by the original or extended return filing due date of the third year. You pay an excise instead of a personal property tax. Sequentially number your excise tax returns for the entire calendar year and start your serial numbers over at 01 at the beginning of each calendar year.

Fill out the form you need to file. Select from commodity type and product. TurboTax Easy Extension is a fast and easy way to file your extension right from your computer.

If you dont already have a MyTax Illinois account click here. Excise Tax on Coal. You will generally need to pay excise duty on either a prepayment basis or a periodic settlement basis when you lodge your excise return.

The tax collector must have received the payment. We will then present bills found matching the options you provided. The Department can waive late return penalties under certain circumstances.

Download permit application and informational packets. In all situations payment of excise duty is due at the same time as lodgment of your excise return. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF.

Submit the form and payment if required. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. PAY Delinquent Excise Tax and Parking Tickets.

If you need more time to pay you can request an installment agreement or you may qualify for an offer in compromise. Please select one of the options below. MassTaxConnect Log in to file and pay taxes.

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. File TTB form on Paygov. Birth Marriage Death Certificates Dog Licenses.

There is no statute of limitations for motor vehicle excise bills. They also have multiple locations you can pay including. How to pay late excise tax online Tuesday March 8 2022 Edit.

IRC 6651 a 1 imposes a penalty for the failure to file a tax return by its required due date determined with regard to any extension of time for filing. Check or money order follow the payment instructions on the form or voucher associated with your filing. Green solvents - 175 or 035 when used at a virgin facility Annual fee varies from 1500 to 5000 depending on type and gallons of solvents used Click here for specific fees Electricity Excise Tax.

MyTax Illinois If you have an MyTax Illinois account click here and log in. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. A motor vehicle excise is due 30 days from the day its issued.

Create account on Paygov. For EFTPS deposits to be on time you must initiate the transaction at least 1 day before the date the deposit is. Plan for and pay your taxes.

Please click on the Invoice Cloud PDF below for a quick guide on how to register. You must deposit all depository taxes such as excise tax employment tax or corporate income tax by electronic funds transfer. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

The penalty rate is 5 percent per month or part of month up to maximum of 25 percent computed on the amount of tax required to be shown on the return. Not just mailed postmarked on or before the due date. Tax classifications for common business activities.

Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. If youre more than 60 days late the minimum penalty is 100 or 100 of the tax due with the return whichever is less. Online payments will have a NON-REFUNDABLE 45 convenience fee added to your total.

What Is Transmittal Form 1096 Irs Forms Irs Tax Forms

Top Benefits By The Best Gst And Income Tax Service Providers In 2022 Filing Taxes Online Taxes File Taxes Online

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax

Penalty For Late Filing Irs 1099 Information Return Irs Forms 1099 Tax Form Irs

Average Real Federal Excise Taxes In Dollars Per Barrel On Alcoholic Download Scientific Diagram

Last Week Of The Month Has Begun Only 5daystogo Heavy Vehicle Use Tax Hvut Form2290 Filing For Taxyear 2018 2019 Understanding Supportive Federation

Accounting Taxation Service Tax Taxable Services Abatement Value Taxable Value Effective Rate New Service Tax Income Tax Return Service Tax

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template 10 Profe Letter Templates Lettering Name Tag Templates

Gst Migration Registration For Existing Assessee Internal Audit Consent Letter Patent Registration

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

All About Gstr1 And Updates Income Tax Return Income Tax Professional Accounting

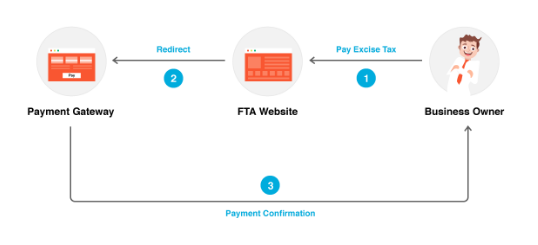

Excise Tax Return Filing And Payment Zoho Books

Have You Or Someone You Know Visited A Tanning Salon If So Then This Excise Tax On Tanning Is A Must To Be Paid Qua Business Offer Tanning Salon Government

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter

Different Types Of Australian Taxes Types Of Taxes Tax Services Business Advisor